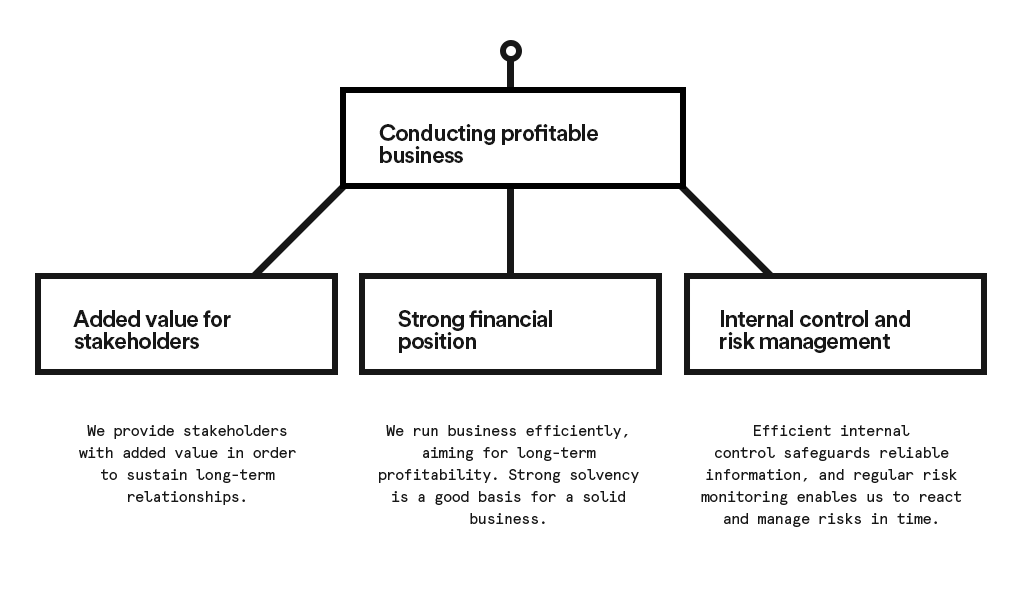

Creating value for stakeholders

The aim of Nordic Morning Group is to run its business in a profitable way, which means creating added financial value for key stakeholders, employees, customers and the owner. Important stakeholders for added value also include partners, service providers, investors and the countries and municipalities in which we operate. Nordic Morning Group consists of the following business areas: Nordic Morning, Edita Prima and Edita Publishing.

Nordic Morning Group follows principles of good corporate governance. Financial management is based on the Group’s policies, effective risk management and the principles of internal control.

Financial performance

Business transformation, building growth and developing a growth mindset continued to be the dominant themes for Nordic Morning Group in 2019. The Group Management Team focused on restructuring operations, building the new organizational setup, implementing the new common enterprise resource planning platform and leading the change.

In 2019, Nordic Morning Group’s operating profit was EUR 0.6 (0.9) million, which was EUR 0.3 million lower than in 2018. The non-recurring income included in the operating profit totaled EUR 0.1 (0.0) million. Non-recurring expenses amounted to EUR -1.0 (-0.5) million. Nordic Morning Group’s operating profit excluding non-recurring items was EUR 1.5 (1.3) million, which was EUR 0.2 million higher than in 2018.

Nordic Morning Group’s consolidated net revenue was EUR 77.6 (EUR 76.4) million. Net revenue grew in the Edita Prima business area thanks to new, more extensive customer agreements that also included postal delivery services. Net revenue declined particularly in the Nordic Morning business areas in Sweden and Finland due to a decrease in subcontracting and lost customers. In the Edita Publishing business area, net revenue decreased mainly due to lower sales of learning materials and made-to-order products.

The Group’s equity ratio decreased by 1.5 percentage points, which resulted in a ratio of 38.6 (40.1) percent by the end of the year.

Nordic Morning Group’s financial performance is explained in full in the 2019 Financial Statements, which can be found at http://reporting.nordicmorning.com/en/financials.

Added value for stakeholders

Nordic Morning Group’s operations bring added financial value to the company’s stakeholders, operating areas and market areas. In 2019, Nordic Morning sold products and services to its customers totaling EUR 78.2 (77.0) million and spent EUR 40.5 (35.9) million on buying goods and services from partners. Nordic Morning Group produced added financial value for stakeholders totaling EUR 37.7 (41.1) million.

The majority of the added economic value goes toward personnel salaries and other social costs: EUR 32.5 (35.3) million. Information on salaries and other remunerations regarding the Board of Directors, CEO and the Group’s Management Team can be found in the 2019 Financial Statements.

Nordic Morning Group’s gross capital expenditure in 2019 totaled EUR 2,0 (EUR 1.8) million. At the Annual General Meeting, the Board of Directors proposed the distribution of a dividend of EUR 0.33 per share, totaling EUR 2.0 (EUR 2.0) million.

A summary of the Group’s added value for stakeholders is provided in the table below.

To safeguard its future, the Group will continue to develop its offerings and processes, invest in developing its people and ways of working, and identify further cost-saving innovations.

Internal control and risk management

Nordic Morning Group aims to effectively secure the profitability of its business operations through good governance, active internal control and risk management.

Every year, the Group conducts risk analyses in conjunction with budgeting. Risks are reported and dealt with immediately. Due to the size of the company and the high level of the company’s internal controls, the Board of Directors decided not to issue a separate assignment for 2019 regarding internal control.

Tax policy

Nordic Morning Group pays taxes on its business income to each operating country, in compliance with local laws and regulations. More information on the Groups's tax policy and operating principles is in the table below.

Added value for stakeholders

| Stakeholder | Indicator | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|

| Customers | Sales | 78 201 | 76 981 | 99 186 | 105 710 | 108 060 | 114 628 | 123 576 | 115 491 | 107 611 |

| Suppliers | Cost of goods, materials and services purchased | 40 485 | 35 891 | 45 670 | 56 703 | 52 546 | 56 583 | 65 590 | 58 634 | 50 443 |

| Added value created (tEUR) | 37 716 | 41 090 | 53 516 | 49 007 | 55 514 | 58 045 | 57 986 | 56 857 | 57 168 | |

| Stakeholder | Indicator | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| Employees | Wages and salaries, pensions, social costs | 32 461 | 35 339 | 41 455 | 49 513 | 50 645 | 45 671 | 48 393 | 51 273 | 48 798 |

| Public sector | Direct taxes | 50 | 26 | 1 026 | -143 | -132 | -102 | 123 | -255 | -40 |

| Financers | Net financing costs | -1 866 | 636 | 421 | 254 | 131 | -49 | -19 | 600 | 707 |

| Charitable organizations | Donations | 0 | 6 | 10 | 134 | 139 | 127 | 124 | 125 | 119 |

| Owners | Dividends | 2 000 | 2 230 | 2 000 | 2 000 | 2 000 | 1 500 | 0 | 0 | 990 |

| Investors | Investments | 2 034 | 1 796 | 11 024 | 5 297 | 7 786 | 3 980 | 3 379 | 7 368 | 5 017 |

| Total added value distributed to stakeholders | 34 678 | 40 032 | 55 937 | 57 055 | 60 569 | 51 127 | 52 200 | 59 111 | 55 591 | |

| Value added remaining in the company | 3 037 | 1 058 | -2 421 | -8 048 | -5 055 | 6 918 | 5 786 | -2 254 | 1 577 | |

| Added value created / FTE (tEUR) | 85 | 87 | 98 | 75 | 78 | 88 | 87 | 81 | 77 | |

Tax policy and operating principles

Nordic Morning Group pays taxes on its business income to the countries in which it operates, in compliance with local laws and regulations.

Nordic Morning Group’s main markets are located in Finland and Sweden. Nordic Morning Group has no companies or business in other countries or countries considered a tax haven. The Group’s aim is to secure and increase shareholder value through profitable and efficiently managed business operations.

The Group’s tax policy is also aimed at securing shareholder value by ensuring that the local tax legislation of each operating country is always complied with, and that taxes are paid to the country in question.

In tax matters that are open to interpretation or otherwise complicated, support is obtained from external tax advisors or the tax authorities, who are requested to provide rulings and advice in advance.

The Group’s objective is to handle its taxes and other levies appropriately, in as timely a manner as possible, and in full compliance with the law.

Nordic Morning Group has prepared a transfer pricing policy that defines the pricing principles for the Group’s internal cross-border trading. The transfer pricing policy is in line with current official guidelines and legislation.

Tax report

Nordic Morning Group pays direct taxes on earnings and property. The Group also influences the economies of the operating countries through indirect taxes, such as value added tax (VAT), as well as other similar charges, such as the employer’s charges and social security premiums that the Group collects on behalf of governments.

In 2019, the Group’s profit before taxes was EUR 0.3 (0.2 million) million. In Finland, the Group was in the corporate income tax bracket, but the taxable profit was negative in Sweden. The Group will pay income taxes of EUR -0,3 (-0.3) million for the financial year 2019.

The amount of confirmed tax losses carried forward from previous years amounted to EUR 9.4 million in Sweden and to EUR 0.1 million in Finland at the end of the 2019 financial year. In 2019, the Group’s effective income tax rate was 16.4 (10.7) percent.

At the end of 2019, deferred tax assets stood at EUR 0.1 (0.1) million and deferred tax liabilities at EUR 0.1 (0.2) million. In accordance with the company’s principals of cautiousness, the Group has not booked any deferred tax receivables from taxes carried forward from previous fiscal years.

Of the taxes paid for the financial year, the most significant item was statutory employer’s contributions at EUR 3,3 (4.1) million, the majority of which was paid to Sweden.

Of the taxes remitted for the financial year, VAT payments totaled EUR 8,3 (10.2) million and withholding taxes totaled EUR 7,3 (7.7) million.

In addition, the Group also pays additional mandatory contributions, other tax-related contributions and indirect taxes associated with its purchases, such as road tolls, energy taxes and insurance taxes.

Tax contribution

| M€ | Finland | Sweden | Group | ||||

|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | ||

| Turnover | 50.7 | 43.8 | 26.8 | 32.6 | 77.6 | 76.4 | |

| Profit before tax | 0.9 | 1.8 | -0.6 | -1.5 | 0.3 | 0.2 | |

| Utilized tax losses | 0.1 | 0.7 | 0.3 | 0.0 | 0.5 | 0.7 | |

| Personnel | 254 | 257 | 187 | 215 | 442 | 472 | |

| Taxes borne 2018-2019 | |||||||

| Corporate income tax | 0.3 | 0.3 | 0.0 | 0.0 | 0.3 | 0.3 | |

| Employment taxes | 0.1 | 0.1 | 3.1 | 4.0 | 3.3 | 4.1 | |

| Taxes on property | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Other taxes | 0.0 | 0.0 | 0.4 | 0.6 | 0.4 | 0.6 | |

| Taxes collected 2018-2019 | |||||||

| Payroll taxes | 3.7 | 3.8 | 3.5 | 4.0 | 7.3 | 7.7 | |

| Tax at source | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Sales VAT | 12.4 | 11.1 | 8.3 | 10.3 | 20.7 | 21.3 | |

| VAT, purchases | -8.7 | -6.8 | -3.8 | -4.3 | -12.5 | -11.1 | |

| VAT, returns | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |